Business Insurance in and around Headland

One of the top small business insurance companies in Headland, and beyond.

Insure your business, intentionally

Insure The Business You've Built.

When experiencing the highs and lows of small business ownership, let State Farm be there for you and help provide quality insurance for your business. Your policy can include options such as extra liability coverage, errors and omissions liability, and a surety or fidelity bond.

One of the top small business insurance companies in Headland, and beyond.

Insure your business, intentionally

Customizable Coverage For Your Business

At State Farm, apply for the fantastic coverage you may need for your business, whether it's a farm supply store, an arts and crafts store or a sporting good store. Agent Melissa Elmore is also a business owner and understands what you need. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

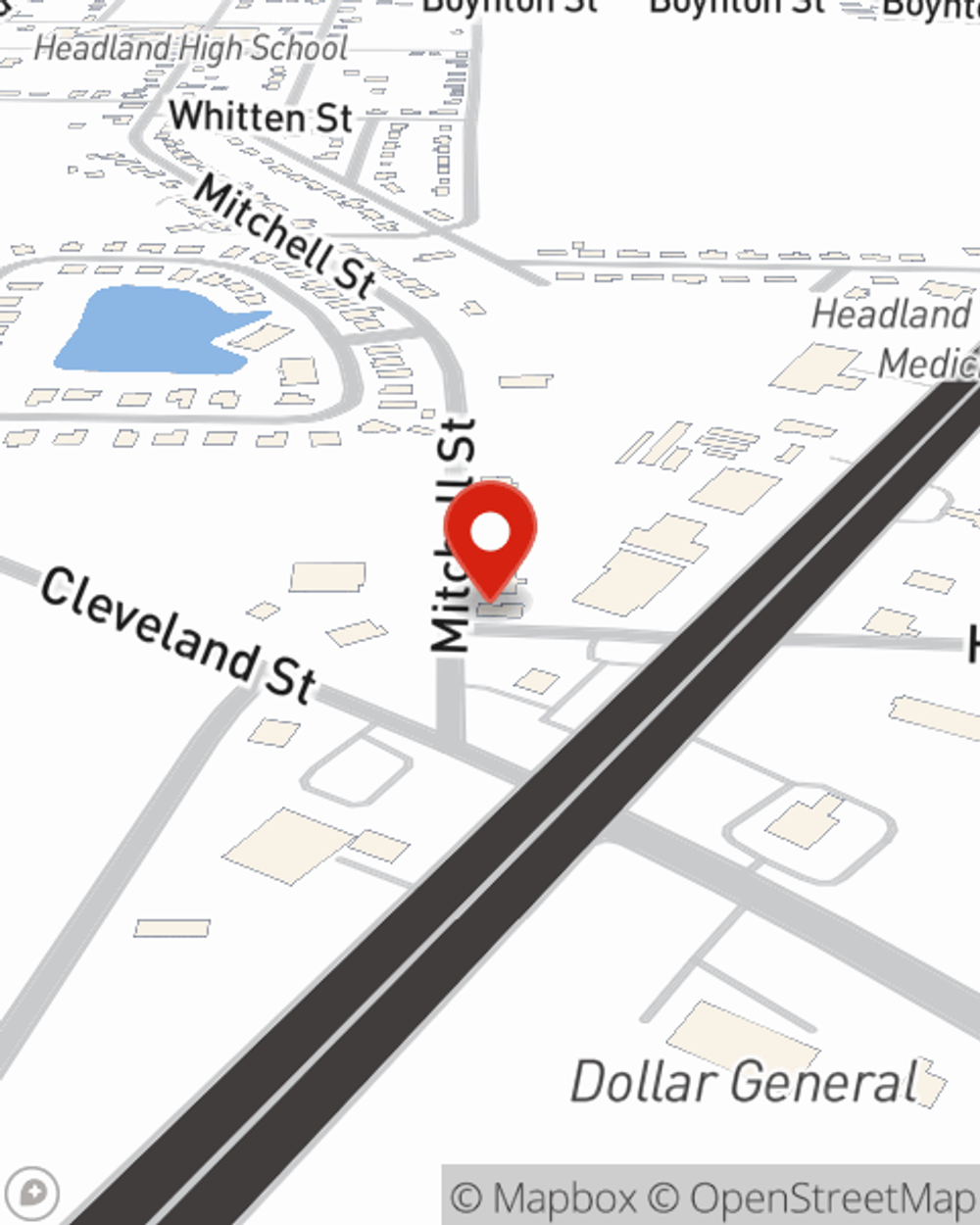

Ready to learn more about the business insurance options that may be right for you? Call or email agent Melissa Elmore's office to get started!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Melissa Elmore

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.